The latest US jobs report came out strong, indicating a still tight labor market. This might signal a more aggressive stance on the part of the Fed. Indeed next week’s CPI data will certainly be more significant in terms of the magnitude of the next interest rate hike at the November meeting. Nevertheless, recent statements from Fed members are pointing towards a more hawkish stance as they see inflation still running high. Neel Kashkari, the president of the Federal Reserve Bank of Minneapolis, stated on Thursday that the US central bank is still far from pausing its aggressive interest rate hikes.

The hawkish remarks from Fed members came in a context of better-than-expected US macro data. On Wednesday, the ISM Services PMI was released and the reading fell less than market forecasts. The ADP report, also released on Wednesday, showed that 208.000 private payrolls were added in September 2022, from an upwardly revised 185.000 in August and above market forecasts of 200.000.

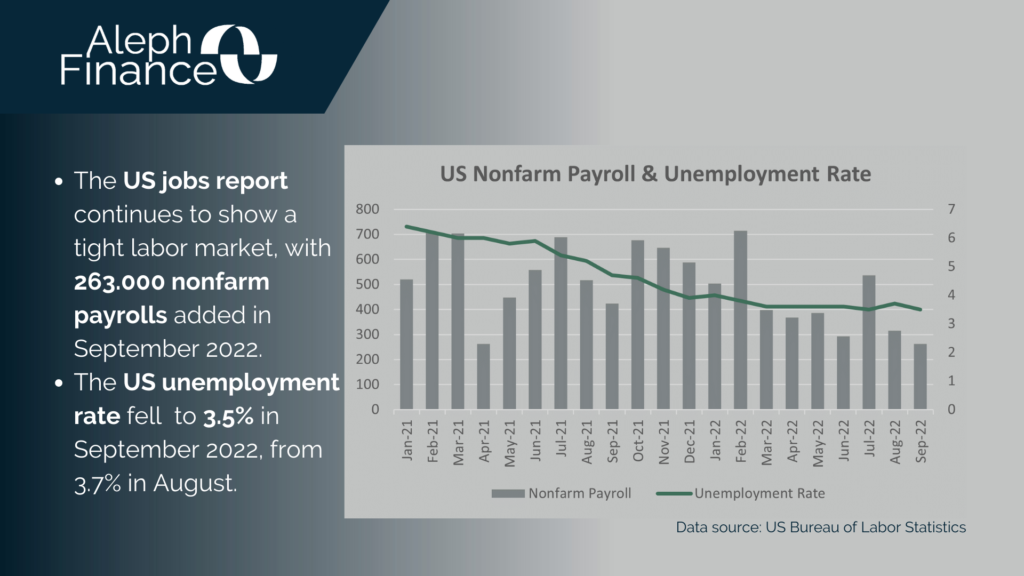

The US Bureau of Labor Statistics reported that nonfarm payrolls increased by 263.000 in September 2022, from 315.000 in August, but better than market forecasts of 250.000. The US unemployment rate fell to 3.5% in September, below market forecasts of 3.7% and matching July’s 29-month low. Year-over-year average hourly earnings increased by 5.0% and participation rate was little changed at 62.3%.

All major indices are down. The CME FedWatch Tool is showing around 80% probability of a 75-basis point rate hike at the next meeting.