The latest official data on employment to assess the labor market situation ahead of the Fed’s September 20-21 meeting. Inflation rate, to be published on September 13, will therefore be the determining variable of the magnitude of the September rate decision. At the moment, the CME FedWatch Tool shows a higher probability of a 75 basis point rate hike.

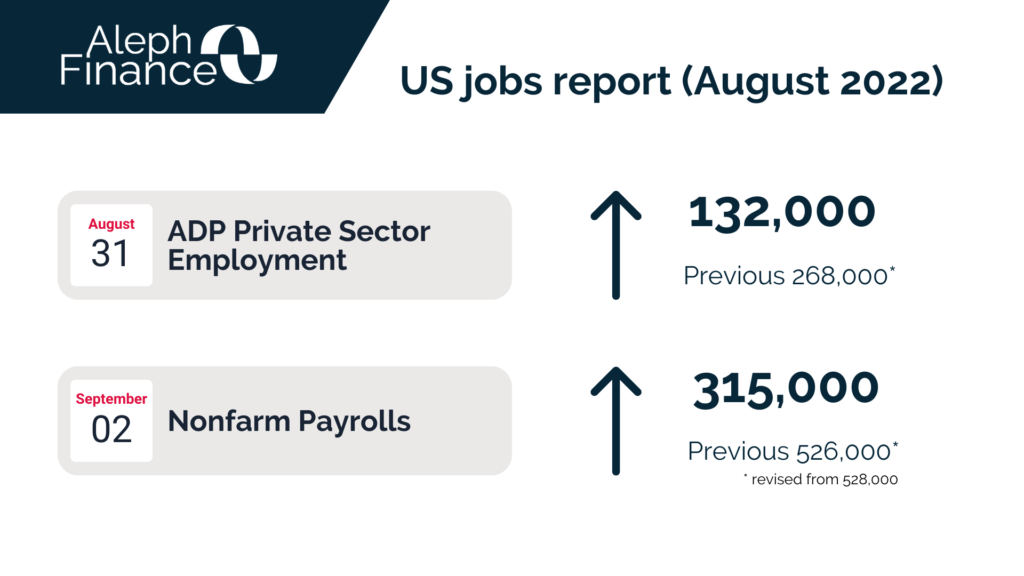

After a hiatus to adjust methodology and start collaboration with Stanford Digital Economy Lab, the ADP report released Wednesday showed that private payrolls grew by just 132.000 in August 2022, down from 268.000 in July. “Our data suggests a shift toward a more conservative pace of hiring, possibly as companies try to decipher the economy’s conflicting signals. We could be at an inflection point, from super-charged job gains to something more normal,” said Nela Richardson, ADP’s chief economist.

The ADP data, which is used to predict the more closely watched employment report by the US Bureau of Labor Statistics, hinted growing concerns over an imminent economic slowdown plagued by inflation. US GDP contracted for the first half of 2022 (-1.6% in Q1 final reading and -0.6% in Q2 second reading), which means that the economy technically entered a recession. Inflation remains well above the Fed’s 2% target.

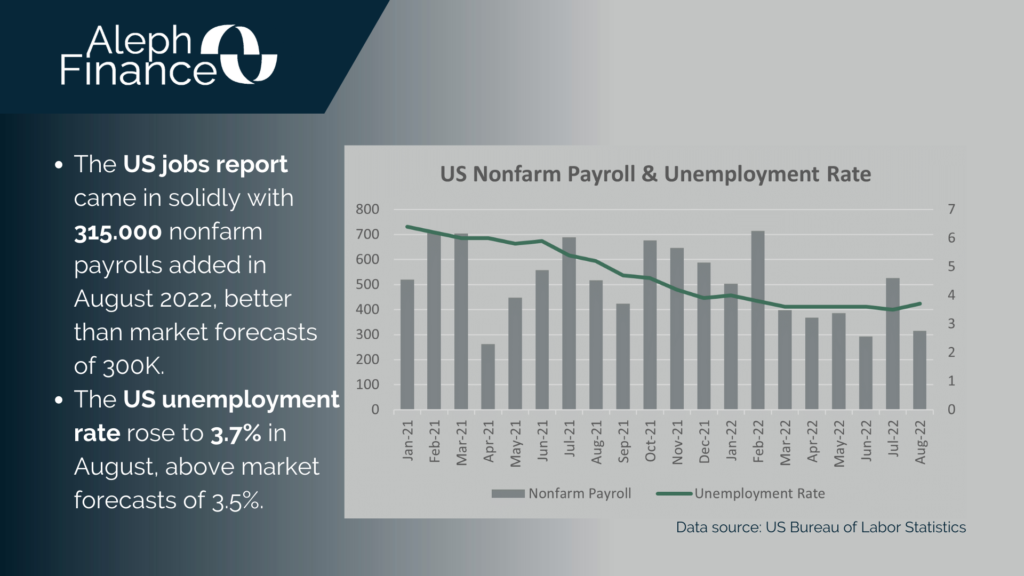

According to the US Bureau of Labor Statistics, nonfarm payrolls increased by 315K in August 2022, from a downwardly revised 526K in July, but better than market forecasts of 300K. The US unemployment rate rose to 3.7% in August, above market forecasts of 3.5% and the highest since February 2022. Year-over-year average hourly earnings increased by 5.2% and participation rate was 62.4%.