The week began with oil prices surging again. Tighter supply concerns persisted following fears of new sanctions against Russia by the EU and halted talks on the Iran nuclear deal. Hossein Amir-Abdollahian, Iran’s foreign minister, stated however that an agreement with the US is close. Iran is now awaiting the US response to its proposals.

The Iran nuclear deal, also known as the Joint Comprehensive Plan of Action (JCPOA), is an arms control agreement reached in July 2015 by the P5+1 (China, France, Russia, the United Kingdom, the United States and Germany), Iran and the EU. To ensure that Iran’s nuclear program is solely for peaceful purposes, the terms Iran agreed to consisted of nuclear restrictions, monitoring, and verification by the International Atomic Energy Agency (IAEA) and in return Iran obtained sanctions relief. Despite Iran’s compliance, in 2018 the stability of the accord was jeopardized when then President of the United States, Donald Trump, decided unilaterally to withdraw the US from the JCPOA. Following the withdrawal, the US imposed fresh sanctions previously lifted. Trump claimed that the deal failed to address Iran’s ballistic missile program and that the sunset provisions would allow Iran to pursue nuclear weapons in the future. Iran started violating the agreement in May 2019. The US will rejoin JCPOA under the administration of current President Biden, but on the condition that Iran returns to full compliance. In April 2021, indirect negotiations began in Vienna between the US and Iran.

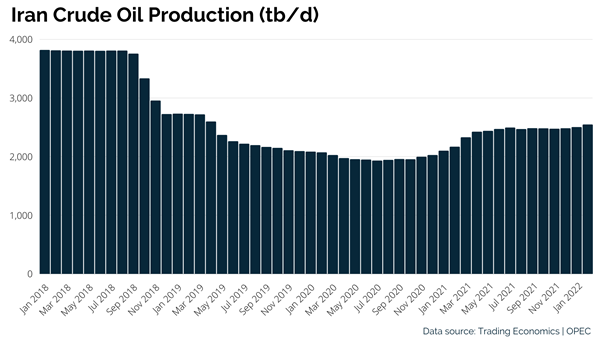

Iran crude oil production and exports dropped after Trump reimposed sanctions in 2018. The Islamic Republic oil production levels in 2020 saw an almost 40-year low. The OPEC Monthly Oil Market Report showed that Iran’s oil production was 2,546 tb/d in February 2022.

The Russia-Ukraine war has further highlighted the negotiations on the Iran nuclear deal and the need to conclude it as soon as possible. Markets, in fact, are closely monitoring the progress of talks to see if restrictions on Iranian crude exports can be lifted. Lifting sanctions on Iranian oil could help offset soaring prices and supply disruptions caused by the war.

Yesterday, the US and its allies announced their plan to release an additional 60 million barrels of reserves, an increase to the 180 million previously committed. The aim of this decision is to compensate for the expected sharp decline in Russian output and to tame inflation. Brent crude futures were up $1.49 to $102.56 per barrel, while WTI crude futures were up $1.36 to $97.61 per barrel.