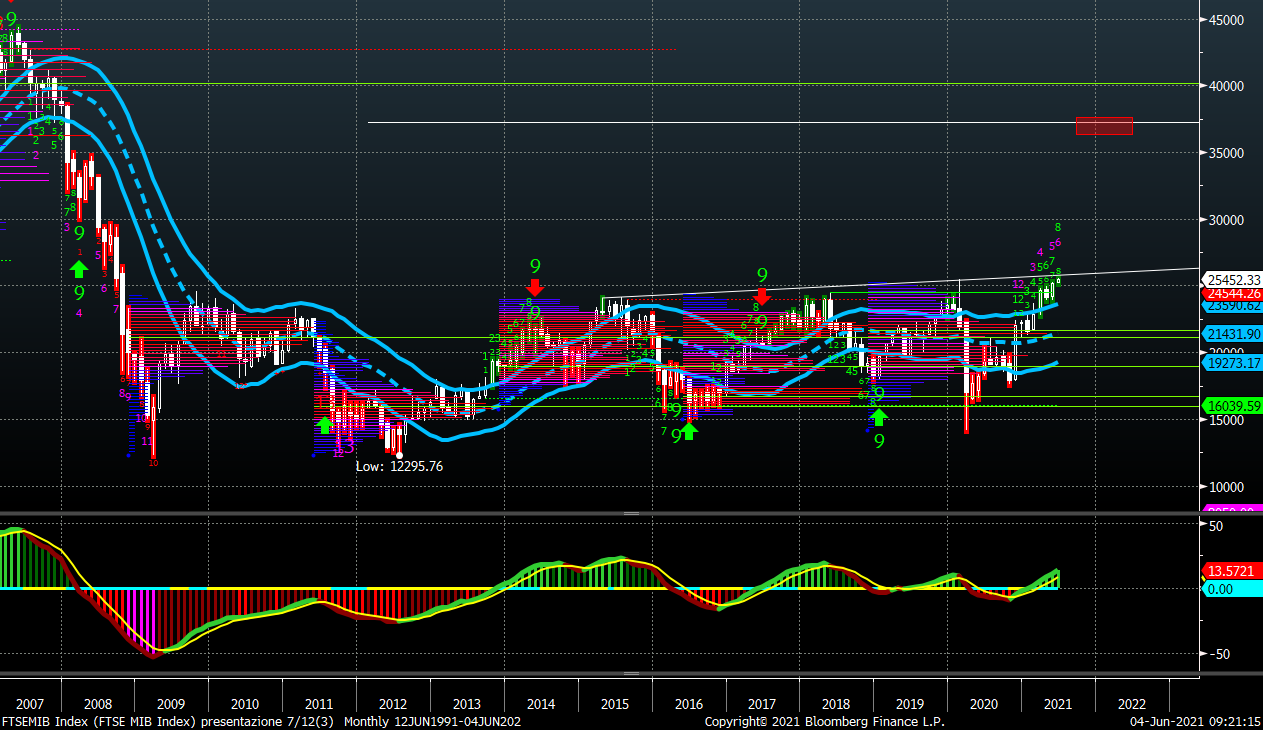

As we can see from the monthly chart below, FTSEMIB index is approaching in these weeks the most important resistance: this resistance has been calculated linking the previous tops of the index (2015, 2018, 2020) and drawing a raising line that in the next couple of weeks will be at 25.900/26.000 level.

DEMARK indicator is marking a 8 this month out of a “9” setup, therefore the most simple reading will tell that next month the market can reach an intermediate top at the resistance level.

On the other way round, if in the next month the market BREAKS on the upside this resistance, we could have in the forthcoming months an acceleration of the bull market, towards 37.000/38.000 points.

As per today, we still think that the correction (a pause in the bull trend) is more likely.

Anyway we will monitor closely this interesting pattern and we will update our analysis consequently.