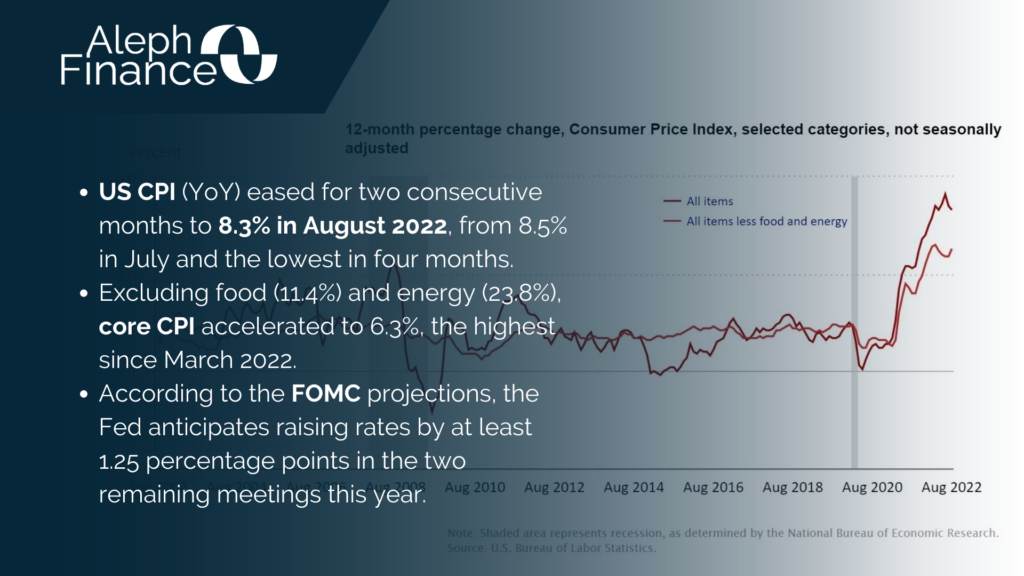

The Federal Reserve announced a third consecutive 75 basis point rate hike yesterday at its September meeting to fight inflation. A three-quarter point rise was highly expected, in fact, the CME FedWatch Tool was showing an 84% probability for an increase of such magnitude prior the announcement. This marks the fifth consecutive rate hike in 2022 by the Fed, bringing the benchmark funds rate to a target range of 3.00% to 3.25%, the highest since 2008. The decision was made amid robust job gains, low unemployment rate and high inflation. The annual CPI in the US was 8.3% in August 2022. Fed Chair Powell reiterated their commitment in bringing inflation back down to 2%. The FOMC expects the target range to continue to rise and added that they will continue to reduce the size of the Fed’s balance sheet.

The FOMC also released its economic projections. The “dot plot” indicated that the Federal funds rate will probably reach 4.4% by the end of the year (higher than the 3.4% projected in June) and 4.6% in 2023 (from the 3.8% projected in June), pointing to a rate cut not until 2024. PCE inflation is also revised upwards, expected to reach 5.4% in 2022 (from the 5.2% projected in June), 2.8% in 2023, 2.3% in 2024 and 2% by 2025. The unemployment rate was revised slightly higher as well, expected to rise to 4.4% by next year. Projections for GDP growth were cut back, indicating a 0.2% expansion this year (from the 1.7% projected in June) and a 1.2% expansion in 2023 (also from 1.7%). Following the Federal Reserve’s announcement, stocks were volatile.