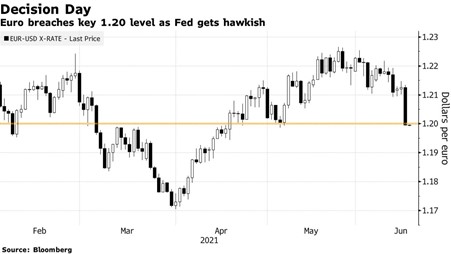

On Wednesday we saw the biggest euro fall since April 2020. Indeed the Euro fell as much as 1.1% to 1.1994 per dollar, right after policymakers reported that the Fed will raise interest rates twice by the end of 2023. This event surprised markets and some even predicted a move next year: the currency broke 1.20, suggesting to some traders that further losses are on the way. Some dollar bears already cut their bets short this week amid speculation that the Fed might surprise with a hawkish view. While, on the other hand, others thought that the central bank’s long-standing view that inflation is transitory meant it would maintain a dovish tone. At the same time US Treasury yields rose along with the greenback, forcing traders to cover shorts.

Summing up its recommendation, Deutsche Bank’s George Saravelos said there’s now “greater scope for a front-end real rate repricing in the U.S. yield curve” and also “room for higher volatility”.

Both factors are bullish for the dollar, he said, adding that “the support the Fed was providing for EUR/USD upside is no longer there”.

The central bank kept the target range for its policy rate unchanged from zero to 0.25%, where it has been since March 2020. It also kept the pace of its monthly bond purchases at $120 billion. The vote of the Federal Open Market Committee was unanimous.

The more aggressively worded signal of the Fed‘s forecast saw the dollar rise, stocks fall and 10-year Treasuries yields jump.

“It’s a hawkish surprise,” said Thomas Costerg, senior US economist at Pictet Wealth Management, speaking of the rate projections. “We’re looking at a Fed that seems positively surprised by the speed of vaccinations and the continued withdrawal of social easing measures.”

Quarterly projections revealed that 13 of 18 officials preferred at least one rate hike by the end of 2023, up from seven in March. Eleven officials saw at least two rises by the end of that year. What’s more, seven of them saw a move as early as 2022, compared with four.

Officials expect price pressures to rise 3.4% in 2021, up from the March projection of 2.4% after The Fed has boosted its inflation forecast to the end of 2023.

Moreover, the 2022 inflation forecast rose to 2.1% from 2%, and the 2023 estimate was raised to 2.2% from 2.1%.

Consumer price pressures have shown to be hotter than expected in the past two months. Labor Department data reported a price jump of 0.8% in April and 0.6% in May, marking the two largest monthly increases since 2009.

GDP Forecasts

The US economic recovery is gaining momentum as trade restrictions and social activity increase across the country. Strong consumer and business demand has exceeded capacity, leading to supply chain bottlenecks, longer lead times and higher prices.

Due to the unprecedented pandemic Fed officials declared such “fits and starts” are to be expected. It also added and expressed optimism about the outlook for the second half of the year as more Americans get vaccinated. The FOMC increased its projections for economic growth. Gross domestic product was seen expanding by 7% this year, from a previous projection of 6.5%. It maintained its 2022 expansion forecast at 3.3% and raised its 2023 estimate to 2.4% from 2.2% in March.