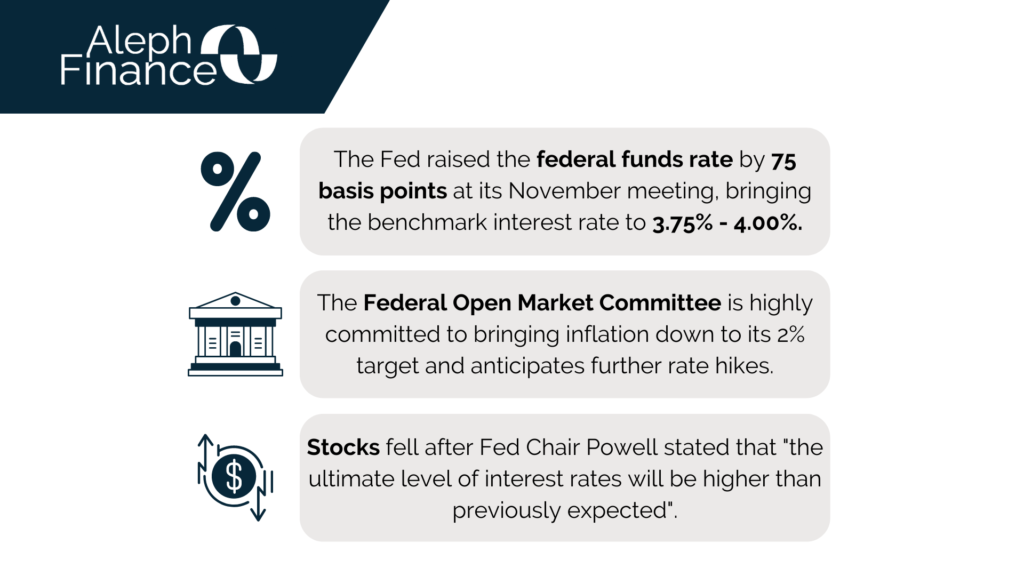

The Federal Reserve raised the funds rate by 75 basis points in its November 2022 meeting. This quarter-point hike was highly expected and brought the Fed’s benchmark to a target range of 3.75% – 4.00%. It marked the sixth consecutive rate hike in 2022 and the fourth 75 basis point hike in a row. The central bank started raising interest rates by +25 bps in March, followed by +50 bps in May, +75 bps in June, +75 bps in July, +75 bps in September, and +75 bps in November to fight persistent inflation. The latest US CPI data from the US Bureau of Labor Statistics showed that inflation was 8.2% year-over-year in September 2022, still well above the Fed’s 2% target.

Investors were expecting the Fed to signal a slowdown in the pace of its rate hikes starting as early as December. Fed Chair Powell stated during the press conference that the incoming data since their last meeting point towards a higher than expected ultimate level of interest rates. After this statement, stocks fell.

The decision came after some strong economic data, showing a resilient US economy. The ADP report, used to predict the more closely watched employment report by the US Bureau of Labor Statistics out this Friday, showed that 239K private payrolls were added in October 2022, up from a downwardly revised 192K in September and above market forecasts of 195K. Other US macro data (ISM Manufacturing PMI and JOLTs Job Openings) also came out better than expected.