All eyes are on the Purchasing Managers’ Index (PMI), a good indicator of the economic condition amidst a situation where demand is weakening and inflation is skyrocketing. The headline inflation in the euro area reached 8.9% in July 2022, a new record high. Core CPI also increased from 3.7% in June to 4.0% in July. Gas prices in Europe have spiked after Russia announced a three-day total shutdown of the Nord Stream 1 pipeline at the end of the month for maintenance, but fears remain that supplies may not resume at the end of that period.

Fears of a recession are proliferating due to the energy crisis and tightening monetary policies. The ECB raised its three key interest rate by 50 basis points for the first time in 11 years at its July meeting. With inflation more than four times the ECB’s 2% target, markets are awaiting the next central bank meeting in September.

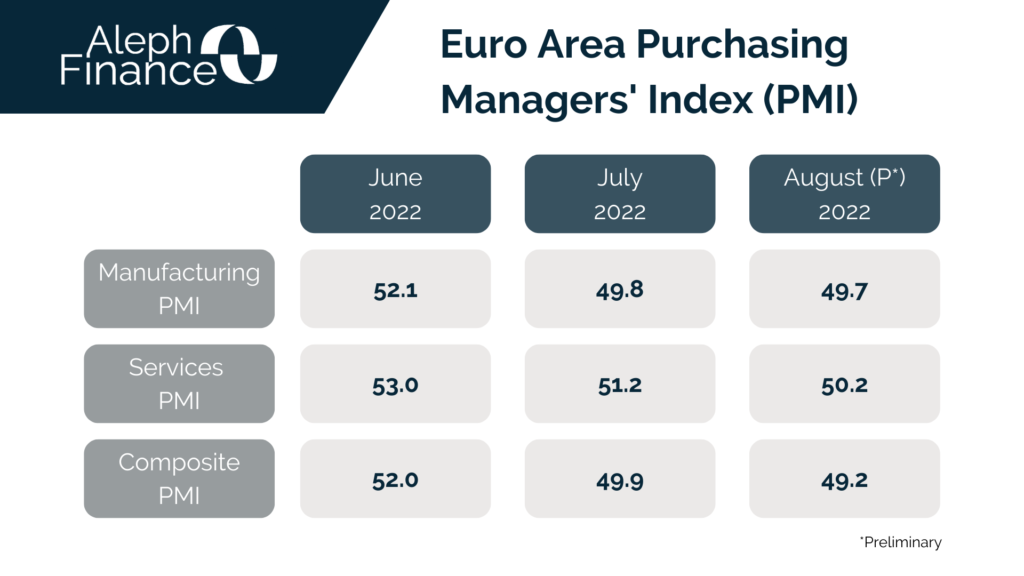

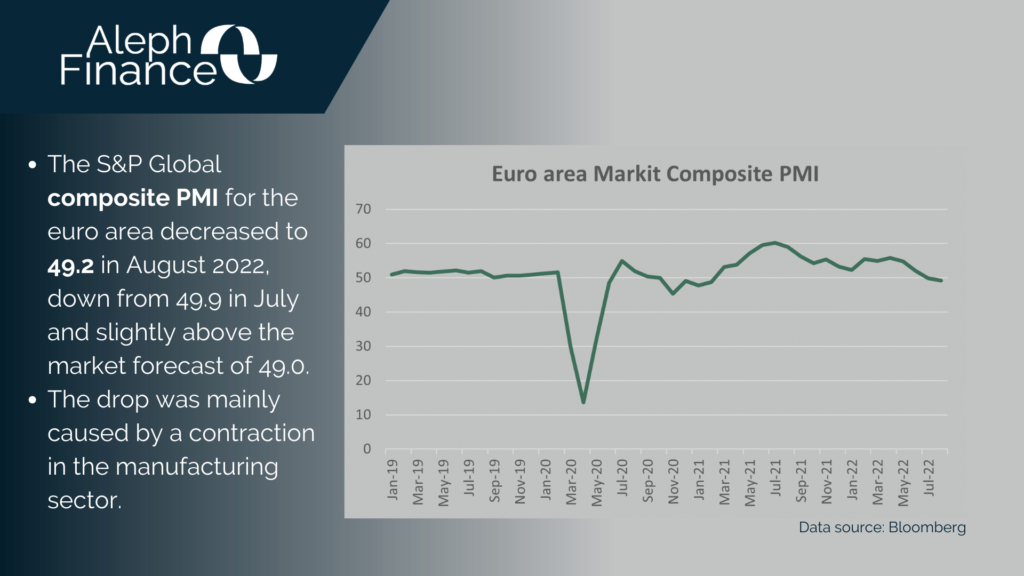

Flash Euro area PMI figures were published today by S&P Global and it showed that business activity fell for the second month in a row. In fact, the S&P Global composite PMI for the Euro area decreased to 49.2 in August 2022, down from 49.9 in July and slightly above the market forecast of 49.0. The reduction comes after a 16-month period of growth. The drop was mainly caused by a contraction in the manufacturing sector, which decreased to 49.7 in August, from 49.8 in July. Services PMI fell to 50.2, from 51.2.