This week the focus is on the Purchasing Managers’ Index (PMI), a good indicator of the health of the economy, which is in a context of high inflation and aggressive tightening of monetary policy.

Economy in the euro area grew 0.1% in the last quarter of 2022, down from an expansion of 0.3% in the third quarter.

Flash headline inflation in the euro area was 8.5% in January 2023, down from 9.2% in December 2022, but still well above the ECB’s 2% target. Core inflation, which excludes prices of energy, food, alcohol and tobacco, was unchanged at 5.2%, a record high, providing proof that price pressures remained strong.

The Governing Council raised the three key ECB interest rates by 50 basis points at its last meeting. This brings the interest rates on the deposit facility at 2.50%, on the main refinancing operations at 3.00% and on the marginal lending facility at 3.25%.

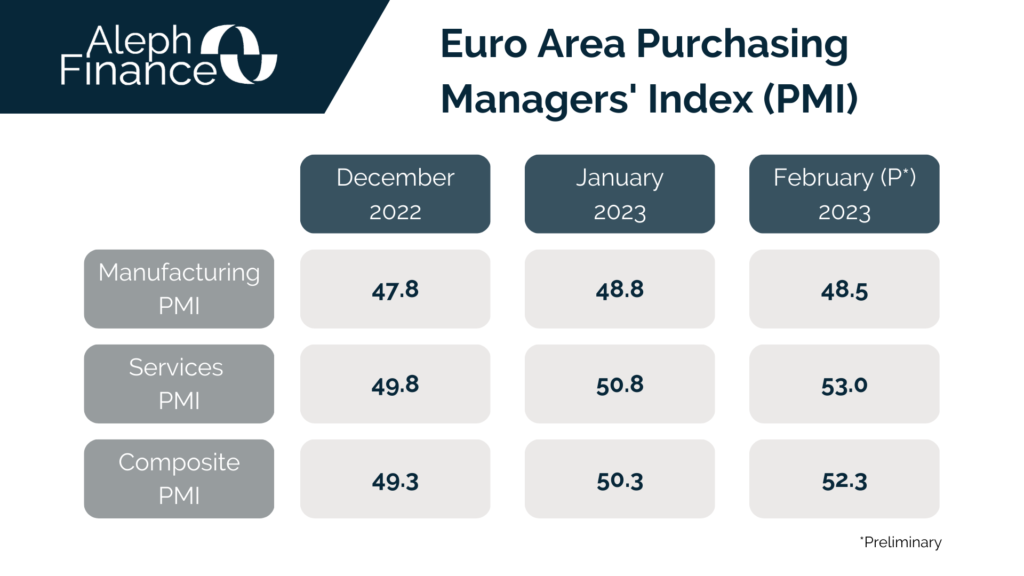

Flash Euro area PMI figures were published today by S&P Global. Among the euro area PMI indicators, the manufacturing PMI was closely watched as it continues to be in contraction territory, unlike the services PMI. In fact, manufacturing PMI decreased to 48.5 in February 2023, while services PMI increased to 53.0 in February 2023, from 50.8 in January 2023. The S&P Global composite PMI for the Euro area increased to 52.3 in February 2023. This flash reading showed the greatest increase in business activity since May, mainly led by the service sector, which advanced to an eight-month high.