The financial turmoil caused by the failures of the Silicon Valley Bank and the Signature Bank has led to a repricing of expectations of rate hikes by central banks. Fear of bank contagion was fueled by the news of Credit Suisse teetering.

Today all eyes were on the European Central Bank (ECB) and its latest monetary policy announcement. In particular, market watchers were awaiting signals from the Governing Council on the pace of future rate hikes for upcoming meetings.

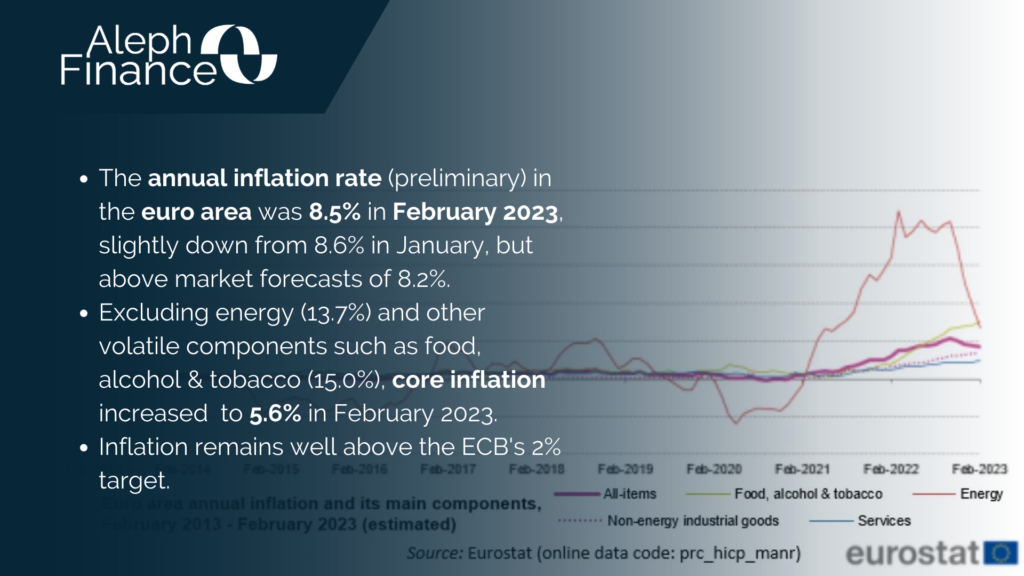

Inflation remains well above the ECB’s 2% medium term target. Preliminary CPI data released by Eurostat showed that headline inflation in the Euro area was 8.5% in February 2023, while core inflation reached 5.6%, a new record high and above market forecasts of 5.3%.

“Inflation is projected to remain too high for too long” said President Lagarde as first statement today. As anticipated, the Governing Council raised the three key ECB interest rates by 50 basis points at its March 2023 meeting. This brings the main refinancing operations rate at 3.50%, the marginal lending facility rate at 3.75% and the deposit facility rate at 3.00%.

In its fight against inflation, the ECB has raised its three key interest rates for six consecutive times (+50 bps in July 2022, +75 bps in September 2022, +75 bps in October 2022, +50 bps in December 2022, +50 bps in February 2023, +50 bps in March 2023). The central bank, about the pace of future rate increases, stated the importance of a data-dependent approach in its decision-making.

According to the updated macroeconomic projections, the ECB staff expects headline inflation to average 5.3% in 2023, 2.9% in 2024 and 2.1% in 2025.

European markets reacted quietly after ECB announcement. Govi’s yields remained steady and equities stable, waiting for the US opening and further news about the situation of the regional banks. Eyes are now on the FED meeting next week.