Today, the focus is on the ECB’s monetary policy decisions. The war in Ukraine, sanctions against Russia, supply bottlenecks and soaring inflation are weighing heavily on the euro area economy. The Governing Councilmust therefore strike a balance between economic slowdown and high inflation. The latter reached a new record high of 7.5% in March 2022, up from 5.9% in February. Energy prices continue to be the main driver, hitting an annual rate of 44.7%.

The ECB was expected to adopt a more hawkish tone and markets were pricing a 70 basis point rate hike by the end of the year. Awaiting the ECB’s decision, European stocks were mixed: the pan-European Stoxx 600 index was 0.2% higher in early trade, with travel and leisure stocks up 1.7% and telecoms down 0.6%.

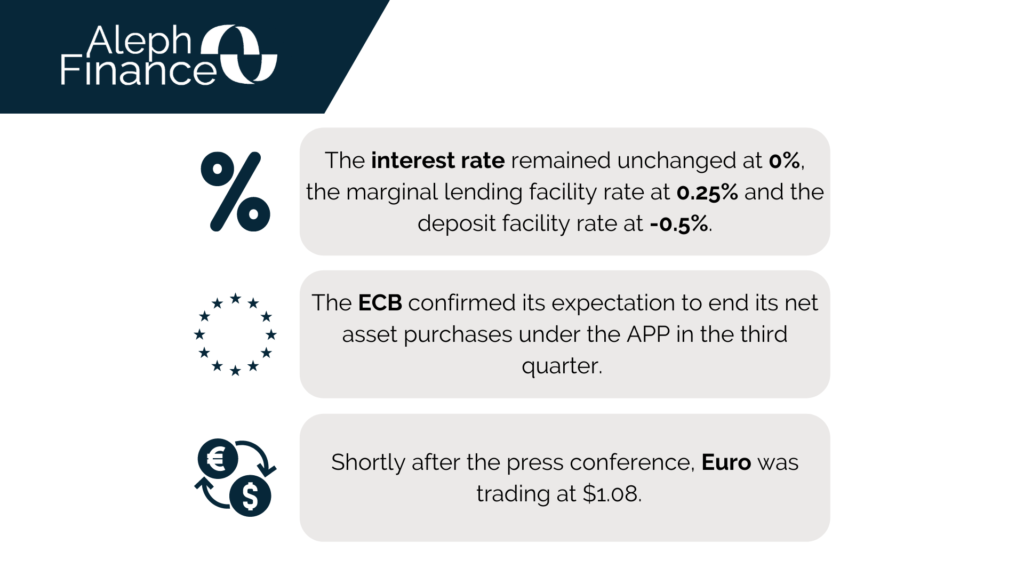

As expected, the ECB maintained the interest rate unchanged at 0%, the marginal lending facility rate at 0.25% and the deposit facility rate at -0.5%. The Governing Council’s previous assessments were reinforced, confirming that the Asset Purchase Programme (APP) will amount to €40 billion in April, €30 billion in May and €20 billion in June, and is expected to end in the third quarter. The bank said that any changes to the key ECB interest rate will occur some time after the end of the APP net purchases.

European stocks were higher as the ECB confirmed the end of its asset purchases in the third quarter while the EURUSD dropped below 1.08.