The European Central Bank just released its monetary policy decisions and its macroeconomic projections amid an uncertain environment, a looming recession and an energy crisis.

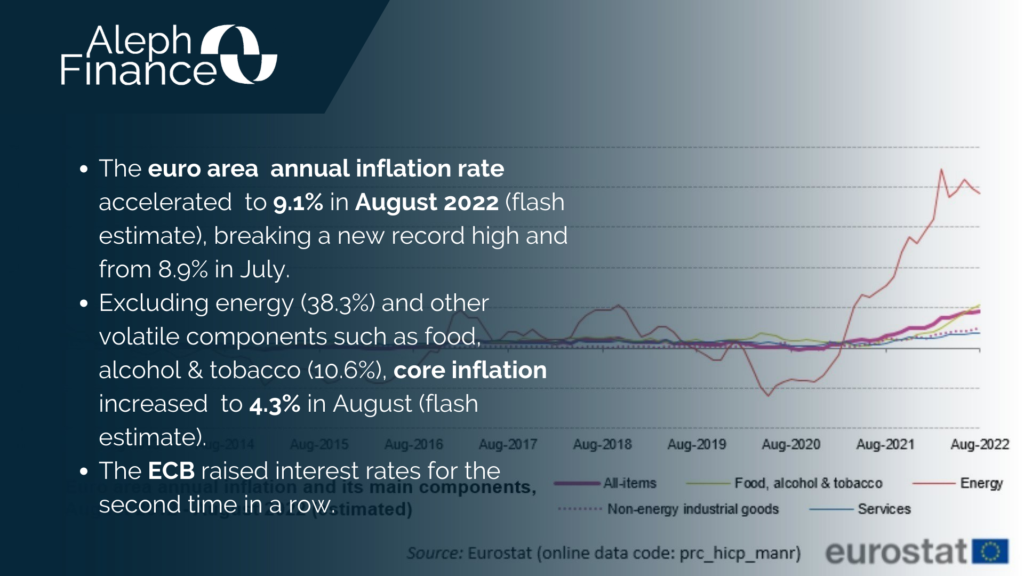

The main decision was between a rate hike of 50 bps and one of 75 bps. Different macroeconomic factors pointed more towards a larger increase. Headline inflation hit 9.1% in August 2022, breaking yet another record high, and the core figure accelerated to 4.3%. The depreciation of the euro against the US dollar is bringing an upsurge in import prices, further triggering cost pressures. Inflation is also expected to reach a double-digit rate in the coming months. The euro area annual growth rate in the second quarter of 2022 was better than expected, with an expansion of 4.1%, higher than 3.9% in the second reading. The unemployment rate in July 2022 fell to a record low of 6.6%. Hawkish statements from several members of the Governing Council also pointed towards a large rate hike.

As widely priced in by markets, the Governing Council raised the three key ECB interest rates by 75 basis points at its September 2022 meeting, from a 50 bps hike in July. The “jumbo” hike brings the main refinancing rate at 1.25%, the marginal lending facility rate at 1.50% and the deposit facility rate at 0.75%. The Governing Council also reported that further raises are expected over the next few meetings to slow demand and fight inflation.

Macroeconomic projections by the ECB staff were revised. Inflation projections have been raised to 8.1% in 2022 (from 6.8% projection in June), 5.5% in 2023 (from 3.5%), and 2.3% in 2024 (from 2.1%). The growth forecast, on the other hand, was lowered to 3.1% in 2022, 0.9% in 2023, and 1.9% in 2024.

Most sectors in European markets fell into negative territory as the ECB announced a 75 bps rate hike.