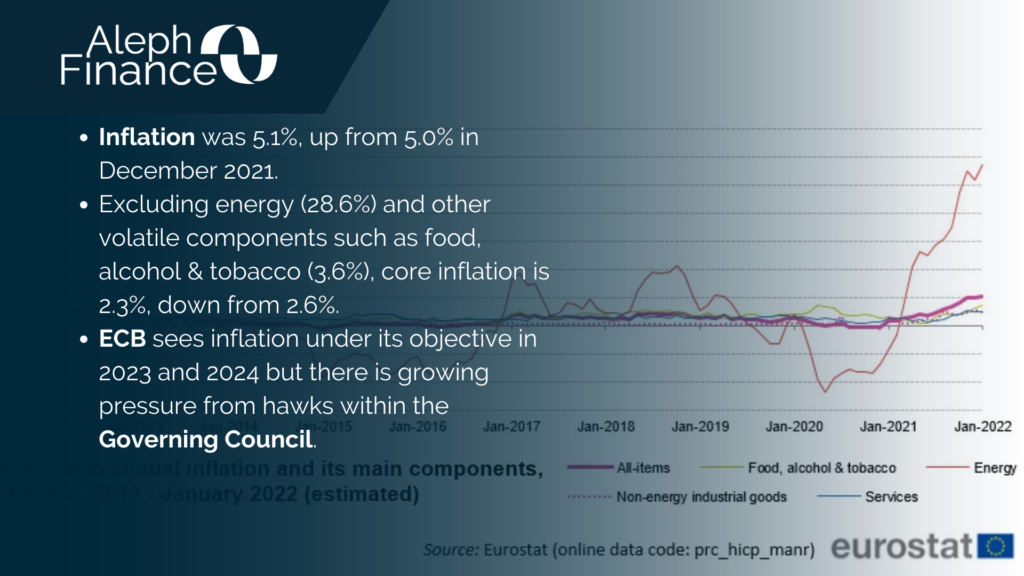

Inflation continues to be a global issue. Yesterday’s Eurozone inflation data came out in line with the previous 5.0% rather than slowing down as Bloomberg analysts had predicted. The index increased by 5.1%, a new record high, posing a new challenge to the European Central Bank’s plan to taper more slowly than its counterparts in the United States and the United Kingdom.

While the Fed has already discarded the narrative that inflation is transitory, President Christine Lagarde has repeatedly stated that the current period of high price growth will end as electricity and heating costs fall. The ECB policy makers set a goal to achieve an inflation level below 2%, but they say that they will change their stance when needed.

As the lack of price breaking is confirmed and inflation is more than double the ECB’s target, hawkish pressures within the board increased, rendering Lagarde’s speech more challenging. Traders are betting on a rate hike, despite ECB officials saying it is unlikely.

Despite record inflationary pressure on the ECB, the interest rate on the main refinancing operations remains unchanged at 0%, the marginal lending facility rate at 0.25% and the deposit facility rate at -0.5%.

Markets in Europe are down on the press conference of the ECB. The German DAX turned red by 0.90%, together with the CAC40 at -0.91% and Milan’s FATSE MIB -0.97%. In fact, German 5-year yield jumped 12 basis points as money market now sees ECB raising rates by 10 basis points in June. Euro is also up 0.7% reaching almost 1.14 level against the US dollar.