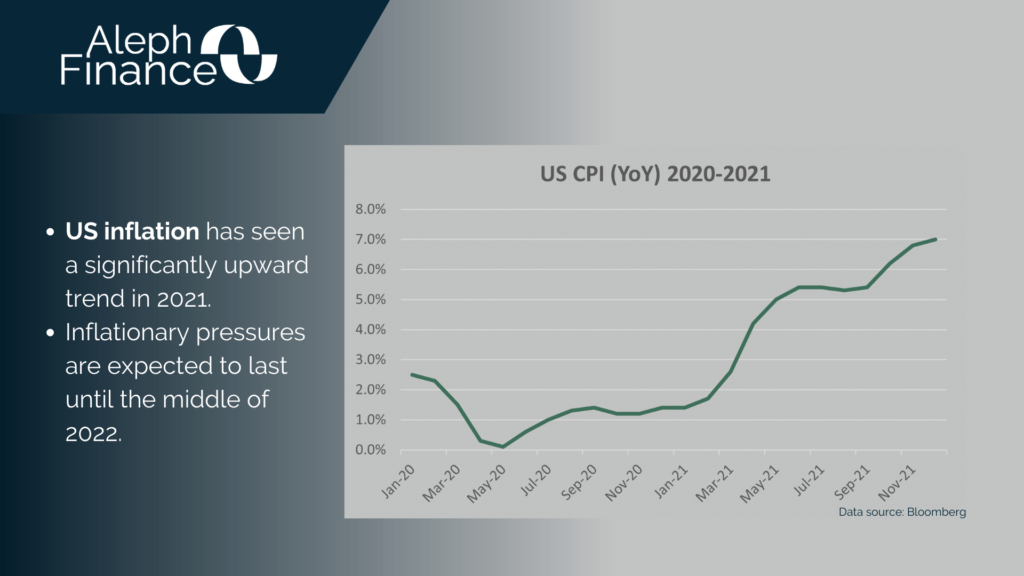

After Friday’s unexpected strong January employment report, this week’s all eyes are on US inflation. Inflation has been accelerating due to energy pressures, increase in used car prices, as well as rents and wages. Hourly earnings rose to 5.7% in January, well above the 5.2% forecasted. The January jobs report has fueled speculation that the Federal Reserve will be more aggressive in raising interest rates.

Yesterday, the US Energy Information Administration (EIA) reported that crude oil stock was -4.756million barrels in the first week of February, less than the expected 0.369 million barrels. Crude prices remain bullish, while concerns over geopolitical risks seems to be attenuated after recent diplomatic efforts.

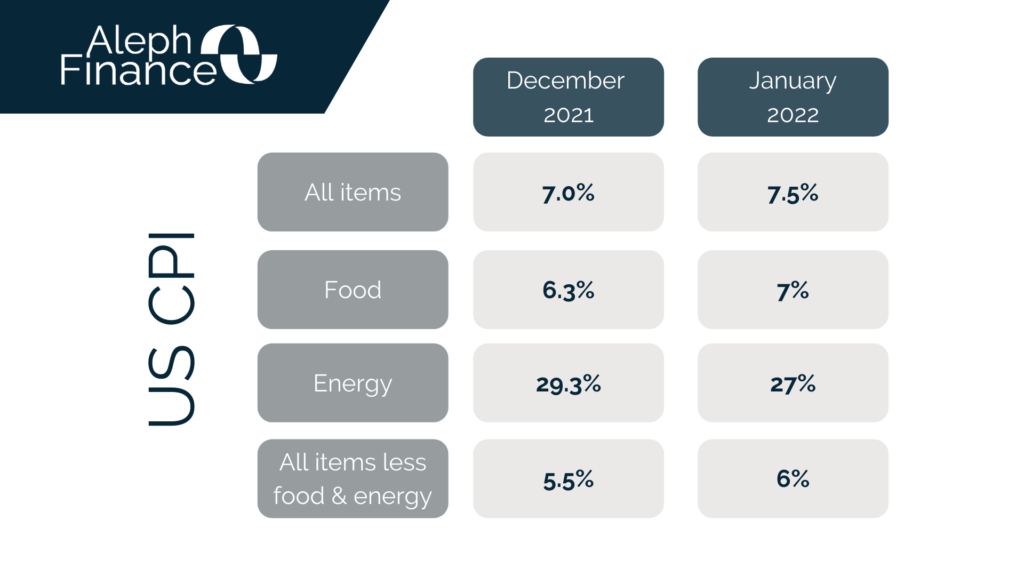

Today the Bureau of Labor Statistics published the Consumer Price Index (CPI) of January, which rose 7.5%, an advance of 0.5% compared to December and the highest annual increase since 1982. The Core CPI, which excludes the volatile food and energy categories, is up 6%. Regardless particular uncertainty about the figure due to recalibration of its components and the heavy reliance of the Federal Reserve on the PCE data, such higher-than-expected CPI will inevitably trigger some action from the FED.

Market reaction after the release has seen a sharp fall in US stock futures. Nasdaq 100 futures dropped more than 1%, S&P 500 futures fell 0.7 percent. European indices have also been affected and EURUSD trades at 1.1384, 60 bp lower.